Crypto markets don’t exist in a bubble. They’re influenced by big economic forces that affect the whole world. Let’s break down these factors in a way that’s easy to understand, even if you’re not an economics whiz.

Key Points

- Monetary Policy: Expansionary policy boosts crypto prices, contractionary policy negatively impacts crypto

- Fiscal Policy: Stimulus measures may increase crypto demand, tightening fiscal policy could reduce risk appetite

- COVID-19 Impact: Expectations of stimulus boosted crypto during lockdowns

- Asset Correlations: Positive with risk assets/equities, negative with USD and interest rates

- Key Economic Indicators: Fed funds rate, Treasury yields, CPI, GDP, and unemployment

- Relevant Crypto Metrics: Bitcoin price, total crypto market cap, and exchange volumes

- Statistical Methods: Correlation analysis and regression models for analyzing relationships

- Data Sources: Federal Reserve Economic Data (FRED), CoinGecko, and CryptoCompare

1. Monetary Policy: The Fed’s Big Impact

The Federal Reserve, America’s central bank, plays a huge role in crypto markets. When they make money cheap by lowering interest rates, people often get more interested in risky investments like crypto. It’s like when your parents give you more allowance – you might spend it on something exciting!

But when the Fed raises rates, it’s like they’re tightening the purse strings. People might pull back from crypto and put their money in safer places. It’s a bit like when your parents say you need to save more – you might not buy that cool new game.

The impact of monetary policy on crypto extends beyond just interest rates. Quantitative easing, where central banks buy securities to inject money into the economy, can lead to increased liquidity in financial markets. This extra cash often finds its way into various assets, including cryptocurrencies, as investors seek higher returns in a low-yield environment.Learn more about trading strategies

2. Government Spending and Crypto

When the government spends a lot of money, like during the COVID-19 pandemic, it can boost crypto prices. Think of it like this: if everyone in your class suddenly got $100, some kids might use that money to buy trading cards. In the crypto world, some people used their stimulus checks to buy Bitcoin or other cryptocurrencies.

But if the government starts cutting back on spending, people might have less money to invest in crypto. It’s like if your school canceled the big end-of-year party – there’s less money floating around for fun stuff.

Government spending also affects inflation expectations, which can drive investors towards cryptocurrencies as a potential hedge. When massive stimulus packages are announced, some investors worry about future inflation and turn to crypto as a store of value, similar to how they might view gold.Explore technical guides for crypto trading

3. The COVID-19 Effect

The pandemic shook up the whole world, including crypto markets. When lockdowns started, many people saw crypto as a safe place to put their money. It was like how some kids started collecting more Pokemon cards during quarantine – it felt like a good way to use their time and money.

As the stock market got really unpredictable, some investors turned to crypto as an alternative. It was like choosing to play video games when the weather outside was too crazy for sports.

The pandemic also accelerated the adoption of digital technologies, including blockchain and cryptocurrencies. With more people working from home and relying on online transactions, the idea of a digital, decentralized currency became more appealing. This shift in mindset contributed to the growing interest in cryptocurrencies during and after the pandemic.Read about COVID-19’s impact on crypto adoption

4. How Crypto Moves with Other Markets

Crypto doesn’t always dance to its own tune. Sometimes it moves up and down with other markets. For example, when the stock market goes up, crypto often follows. It’s like how if your friends all start liking a new band, you might check it out too.

But crypto also has its own quirks. When the US dollar gets stronger, crypto prices often drop. It’s a bit like how when one sports team in your school gets really popular, other teams might lose some fans.

The correlation between crypto and traditional markets has become more pronounced in recent years. During times of market stress, cryptocurrencies have sometimes shown a tendency to move in tandem with risk assets like stocks, particularly tech stocks. This relationship challenges the notion of crypto as a completely uncorrelated asset class and highlights the complex interplay between digital and traditional finance.Master crypto trading with technical analysis

5. Inflation and the “Digital Gold” Idea

Some people call Bitcoin “digital gold” because they think it can protect against inflation. Inflation is when money loses its value over time – like how a candy bar that cost $1 when your parents were kids might cost $2 now.

The idea is that because there’s a limited amount of Bitcoin, it might hold its value better than regular money. But this is still a new idea, and we’re not sure if it really works that way yet.

The concept of Bitcoin as a hedge against inflation gained traction particularly during periods of high inflation and economic uncertainty. However, its effectiveness as an inflation hedge is still debated among economists and investors. Unlike gold, which has a long history as a store of value, Bitcoin’s relatively short existence means its long-term behavior during various economic cycles is still being observed and analyzed.Compare Bitcoin and gold as inflation hedges

6. Economic Health Indicators

Just like how you might check the weather before planning a picnic, investors look at economic indicators before making decisions. Things like GDP (how much a country produces), inflation rates, and unemployment numbers can all affect crypto prices.

For example, if unemployment is high, people might have less money to invest in crypto. It’s like how if lots of kids in your class lost their allowance, fewer people would be trading baseball cards.

Economic indicators also influence market sentiment, which can have a significant impact on crypto prices. Positive economic data might boost overall market confidence, leading to increased investment in riskier assets like cryptocurrencies. Conversely, negative economic indicators might cause investors to seek safer havens, potentially moving away from crypto. Understanding these relationships can help investors anticipate market movements and make more informed decisions.Key economic indicators for crypto investors

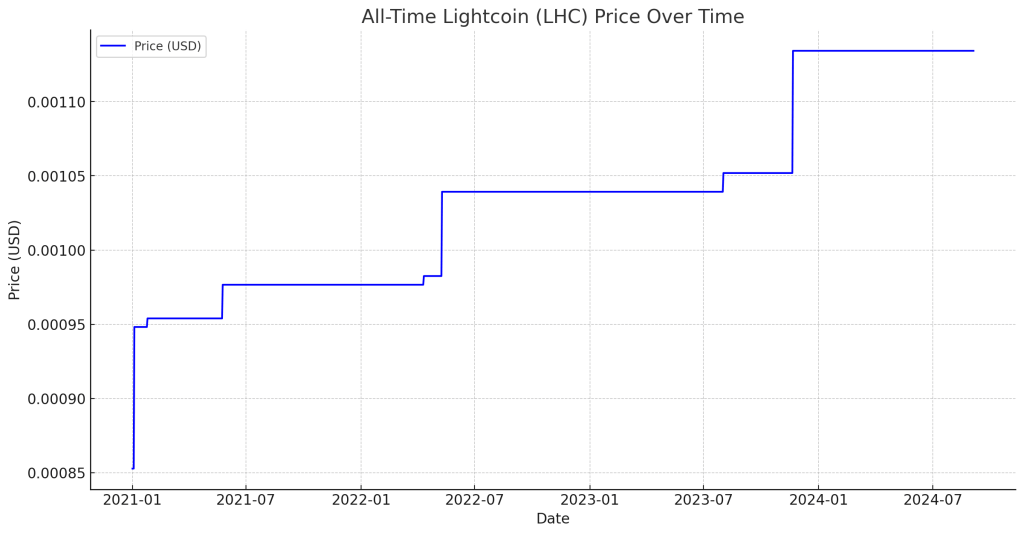

Economic Indicators and Bitcoin Price Correlation

7. Global Events and Crypto Ripples

Big world events can cause waves in the crypto world. Things like elections, trade deals, or even natural disasters can change how people feel about investing in crypto. It’s like how a big thunderstorm might change your plans for a backyard campout.

For instance, when there’s uncertainty in the world, some people might buy more crypto as a way to protect their money. Others might sell their crypto to have more cash on hand. It’s all about how people react to what’s happening around them.

Geopolitical events can have particularly strong effects on crypto markets. For example, when countries experience political instability or economic sanctions, their citizens might turn to cryptocurrencies as a way to preserve wealth or conduct international transactions. This can lead to increased demand and price volatility in certain regions. Understanding these global dynamics is crucial for investors looking to navigate the crypto markets effectively.Explore geopolitical impacts on crypto

8. Big Investors Enter the Game

When large companies or wealthy individuals start buying crypto, it can have a big impact on the market. It’s like if a famous athlete started collecting the same trading cards you like – suddenly, everyone might want them!

These big players can move prices up or down depending on whether they’re buying or selling. They can also bring more attention to crypto, making more people interested in it.

The entry of institutional investors into the crypto space has been a game-changer for the market. As more hedge funds, asset managers, and even corporations add cryptocurrencies to their portfolios, it lends credibility to the asset class and can lead to increased liquidity and stability. However, it also means that crypto markets are becoming more intertwined with traditional financial markets, potentially affecting their behavior during economic cycles.Read about institutional investors in crypto

9. Rules and Regulations

Governments around the world are still figuring out how to handle crypto. When they make new rules, it can change how people use and invest in cryptocurrencies. It’s a bit like how new school rules might change how you play at recess.

For example, if a country decides to ban crypto, prices might drop as people in that country sell their holdings. But if a country makes it easier to use crypto, prices might go up as more people get involved.

Regulatory developments can have both short-term and long-term effects on crypto markets. While increased regulation might initially be seen as a negative by some crypto enthusiasts, clear and fair regulations can actually benefit the industry by providing greater certainty for businesses and investors. Countries that establish crypto-friendly regulations often see increased innovation and investment in blockchain technology, which can drive growth in the sector.Navigate global crypto regulations

Conclusion: Navigating the Crypto Seas

Understanding how these big economic factors affect crypto can help you make better decisions if you’re interested in investing. It’s like knowing the rules of a game before you start playing – you’ll have a better chance of doing well.

Remember, the crypto world is still new and can be unpredictable. It’s important to learn as much as you can and never invest more than you can afford to lose. Think of it like trying a new hobby – start small, learn the ropes, and have fun!

As the crypto market continues to evolve, staying informed about macroeconomic trends and their potential impacts on digital assets becomes increasingly important. By considering factors like monetary policy, global events, and regulatory changes, investors can develop a more comprehensive approach to crypto investing. However, it’s crucial to remember that while these factors can provide valuable insights, the crypto market remains highly volatile and unpredictable. Always conduct thorough research and consider seeking advice from financial professionals before making investment decisions.Discover crypto investment strategies for beginners

Leave a Comment