Analyzing Bitcoin’s ‘Perfect Setup’ Amid Historic Golden Cross

In the bustling world of cryptocurrency, few events spark as much debate and excitement as the Bitcoin Golden Cross—a promising signal that may foreshadow a substantial rally in Bitcoin’s price. In the recent YouTube video titled “Analyzing Bitcoin’s ’Perfect Setup’ Amid Historic Golden Cross,” emerging trends and significant market movements are dissected, illustrating why many analysts feel a surge is on the horizon. With news of regulatory advances from the UK recognizing Bitcoin as personal property and the renewed interest from institutional investors through Bitcoin ETF inflows, a wave of optimism is sweeping through the crypto community.

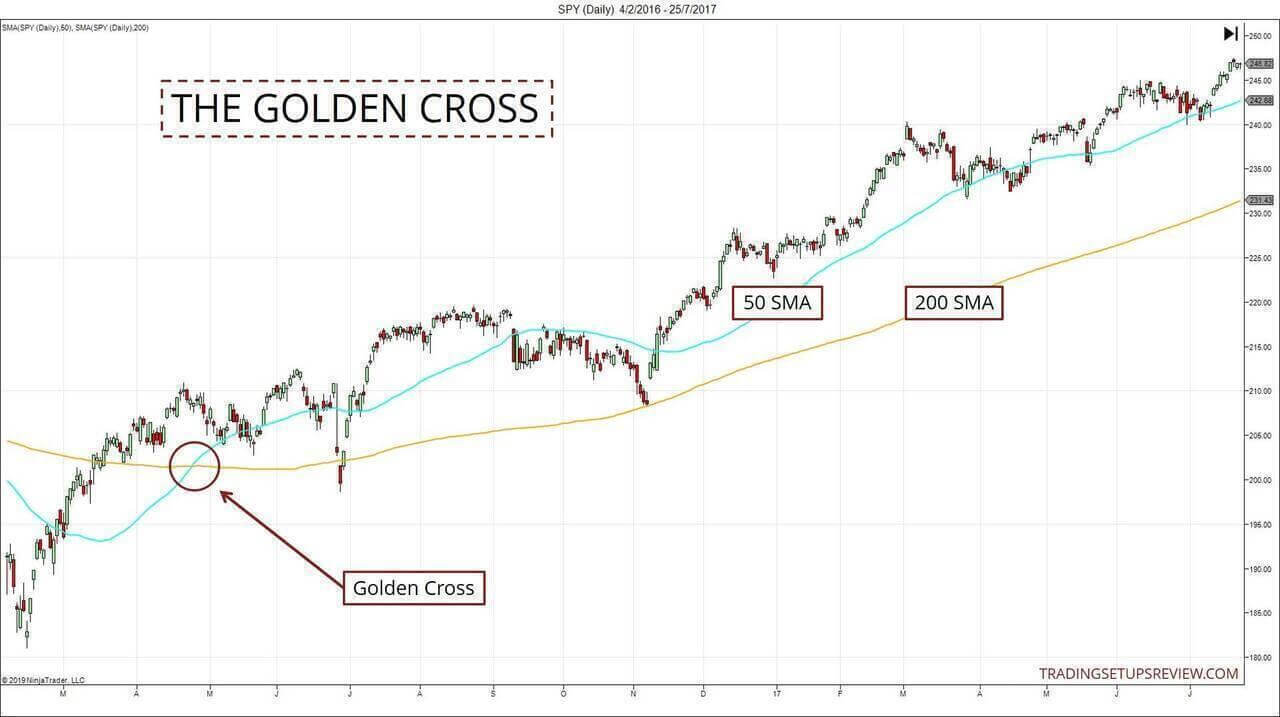

But what does it really mean when the charts flash a ‘Golden Cross’? In simple terms, this technical indicator occurs when a shorter-term moving average crosses above a longer-term moving average, signaling a potential shift in market momentum. The video explores this phenomenon in the context of historical data, considering previous instances where such crosses have led to noteworthy price increases. Coupled with discussions about the recent ‘death cross’ and the complexities of various moving averages, the video provides a comprehensive look at how traders interpret these signals.

Join us as we delve deeper into the content of this insightful video, examining how the current market dynamics, patterns, and regulatory developments might shape the future path of Bitcoin. Are we on the brink of a massive rally, or is caution warranted? Let’s find out together!

Analyzing the Golden Cross Phenomenon and Its Historical Significance

The Golden Cross phenomenon occurs when a shorter-term moving average crosses above a longer-term moving average, signaling potential bullish momentum in the market. In the context of Bitcoin, the recent formation of a Golden Cross on the two-month chart has sparked conversations among traders and analysts alike. Historical data highlights that every time this specific pattern emerged, it preceded notable price rallies. Such occurrences not only indicate a shift in momentum but also correlate with pivotal developments in the broader market. For instance, recent regulatory advancements in the UK, which recognized cryptocurrency as personal property, have injected significant optimism among investors and institutions, reaffirming the potential for Bitcoin’s market resurgence.

Moreover, the shifts in market dynamics are complemented by the positive inflows into Bitcoin ETFs, suggesting institutional players are re-entering the market. While the belief exists that Golden Crosses function as trailing indicators, the two-month timeframe has demonstrated a capacity to lead, often forecasting upward price movements that follow. Traders must, however, exercise discernment, as not all Golden Crosses yield actionable trading signals. Elements such as the specific moving averages employed—such as the traditional 50-day and 200-day versus the two-month perspective—are critical in gauging the validity and potential profitability of these patterns in the current market context.

The Impact of Regulatory Developments on Bitcoins Market Dynamics

Adding to this optimistic landscape is the momentum generated by increased inflows into Bitcoin ETFs, marking a healthy progression in the asset’s market dynamics. Healthy markets often see a pattern of forward movement followed by necessary corrections, akin to a five steps forward, two steps back rhythm. This cyclical behavior indicates that investors are not only responding positively to the overall market conditions but also adjusting their strategies in anticipation of Bitcoin’s potential rallies, particularly as we approach key technical indicators like the Golden Cross. With institutions beginning to accumulate once again, it becomes crucial for investors to remain vigilant and responsive to both market signals and ongoing regulatory developments.

Institutional Accumulation: A Bullish Indicator for Future Growth

As we analyze the past cycles, the correlation between Golden Crosses and subsequent Bitcoin rallies becomes increasingly clear. Institutional activity often serves as a precursor to broader market movements, acting as a catalyst for retail investor enthusiasm. This interplay not only reinforces existing bullish sentiment but also creates an environment ripe for future growth. Key indicators that support this bullish outlook include:

- Increased ETF inflows: Signaling growing institutional interest.

- Regulatory advancements: Enhancing the legitimacy of Bitcoin in global markets.

- Historical patterns: Previous Golden Crosses have led to price surges.

Navigating Market Signals: Understanding Death Crosses and Their Implications

In the world of cryptocurrency, particularly Bitcoin, understanding various market signals like the Golden Cross and Death Cross can illuminate underlying momentum shifts. A Golden Cross arises when a shorter-term moving average crosses above a longer-term moving average, generally signaling potential bullish momentum. The recent recognition of Bitcoin as personal property by the UK government and positive ETF inflows are significant bullish indicators that align with the formation of a Golden Cross on the two-month chart. Historical patterns reveal that past instances of this signal have often preceded substantial rally periods, prompting many traders to ask: could this time be a repeat of history?

Conversely, the Death Cross occurs when a shorter-term moving average dips below a longer-term one, indicating a potential bearish trend. This often serves as a cautionary signal for traders, especially when it manifests after a price rally. While some believe Death Crosses are merely lagging indicators, they still highlight the market’s susceptibility to rapid downturns. Understanding these crossovers is crucial for traders, as not all crosses are created equal. Certain time frames, such as the two-month chart used here, can lead to different implications compared to others, emphasizing the need for nuanced analysis when navigating these market signals.

In Retrospect

As we wrap up our exploration of Bitcoin’s ’Perfect Setup’ amid its historic Golden Cross, it’s essential to reflect on the key insights we’ve gleaned. From the promise of potential massive rallies following past Golden Crosses to the recent regulatory developments in the UK recognizing cryptocurrencies as personal property, the landscape for Bitcoin appears increasingly bullish.

The dialogue around both Golden Crosses and Death Crosses serves as a reminder of the intricate dance between market sentiment and technical indicators. As we’ve learned, while historical patterns can provide valuable insights, they don’t guarantee future performance. Understanding these dynamics can help us navigate the market more effectively, whether we’re seasoned traders or curious newcomers.

The journey of Bitcoin continues, marked by volatility, opportunity, and, as we’ve seen, significant institutional interest. As we stand on the brink of another potential surge, it’s crucial to stay informed, remain vigilant, and perhaps even reconsider our trading strategies in light of these developments.

Thank you for joining us in this analysis. We hope you gained valuable perspectives to enhance your understanding of the crypto market. Stay tuned for more insights, and as always, happy trading!

Leave a Comment